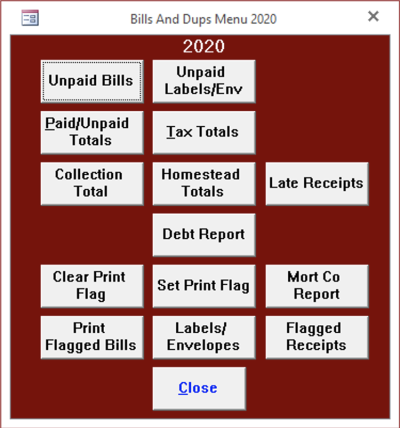

Bills and Dups Menu

Unpaid Bills

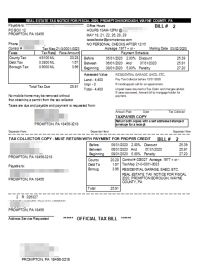

The Unpaid Bills button will print bills for those that remain unpaid. Real Estate and PerCapita/Occupation print separately. We have placed the address on the bill to show through a window envelope after folding.

An asterisk (*) appears next to the bill number for properties that are for sale by Tax Claim. Unpaid bills can be selected by zip code,

leave this field blank to print all unpaid bills.

Unpaid Labels/Env

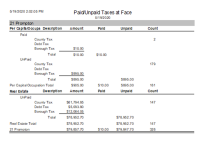

Paid/Unpaid Totals

Paid/Unpaid Totals prints a summary report of the current amounts of paid and unpaid tax bills. The amounts on this report will correspond to your duplicate when you receive the data file but will change as you add bills or change amounts.

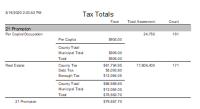

Tax Totals

Tax Totals also produces a summary report. The amounts on this report will correspond to your duplicate when you receive the data file but will change as you add bills or change amounts.

Collection Total

Collection Total provides you with tax totals collected between dates that you specify.

Homestead Totals

Homestead Totals provides counts of the paid/unpaid bills entitled to the Homestead exemption.

Late Receipts

Late Receipts displays payments recorded between two user specified dates that were posted after their due date. Everyone realizes that some payments will be recorded after the due date because of mail delays or for other reasons so the inputs include a Grace Period that will cause the report to ignore payments recorded within that many days of the due date. The report displays payments where the Payment Date is after the Start of Face for discount payments, after the End of Face for face payments, or after the respective installment due date for face installment payments.

Debt Report

Set Print Flag

The set print flag button sets or the print flag for every record of a selected tax type. The print flag for an individual bill can be turned off and on from either the Receipt Form or the Change Form.

Clear Print Flag

The clear print flag button clears the print flag for every record of a selected tax type. The print flag for an individual bill can be turned off and on from either the Receipt Form or the Change Form.

Mort Co Report

The Mort Co Report button will prompt you to select a mortgage company and tax type (Municipal or School) then list each bill with the bill number, tax map number, owner name, description of the tax and the taxes at discount, face and penalty for the selected mortgage company. If the mortgage company is left blank, then the program will print receipts for the bills with the print flag set.

Print Flagged Bills

The Flagged Bills button will prompt you to select a mortgage company and tax type (Municipal or School), and then print bills for all bills of that tax type for the selected mortgage company. If the mortgage company is left blank, then the program will print bills for the bills with the print flag set.

Labels/Envelopes

The Labels/Envelopes button will print labels and envelopes based on the status of the print flag. The program is setup to use labels 1 x 2 5/8; this corresponds to Avery number 5160.

Flagged Receipts

The Flagged Receipts button will prompt you to select a mortgage company and tax type (Municipal or School), and then print receipts for all bills of that tax type for the selected mortgage company. If the mortgage company is left blank, then the program will print receipts for the bills with the print flag set.