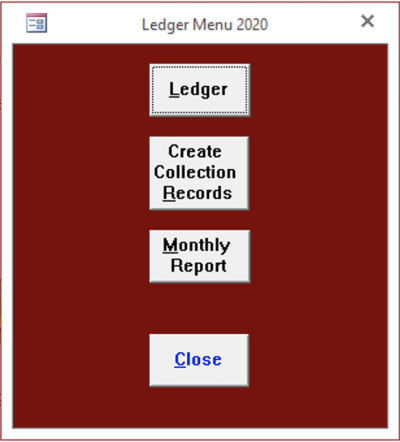

Ledger Menu

There is a Ledger Menu button on the Main Menu. This provides several functions that produce the Monthly report required by the state.

Ledger

The Ledger holds the records necessary to create the Monthly Report. In order to view records, you must select a Tax Type (County, Municipal or School) in the field at the bottom of the form. You use this same field to change the Tax Type in order to see records for the different Tax Types. If your county issues interim taxes, you will also have a pull down for Ledger Type that will allow you to select ledgers for Interim and Supplemental taxes. Each record has fields named Report Year and Month that determines the month in which it appears on the Monthly Report. In subsequent months, the records are used to compute the Balance Collectable (line 1). The next several paragraphs describe the different record types that appear in the second field of the Ledger records. It may help to refer to a copy of the Monthly Report in order to understand the purpose for these entries.

Starting Balance

When you receive your municipal data, we will have already entered the records with the Starting Balances for the different kinds of taxes. The only records in the ledger should have Starting Balance in the type column. On your first report, this will appear on line 1. In subsequent months, the amount that appears on line 8 of the report on the prior month will appear on line 1. For school taxes the program will create the starting balances when you import the school bills.

Addition

The program automatically creates Addition records when you increase the assessment on a property thereby increasing its taxes or create a new bill. Addition records are also created if you create or increase an Occupation or Per Capita Tax. The Bill Number, Control Number and Name appear in the Desc field. Additions appear on line 2A of the Monthly Report.

Deduction

The program automatically creates Deduction records when you decrease the assessment on a property thereby decreasing its taxes. Deduction records are also created if you decrease an Occupation or Per Capita Tax. The Bill Number, Control Number and Name appear in the Desc field. Deductions appear on line 2B of the Monthly Report.

Collection

The program creates collection records when you Export Payments on the Reports Menu or click on Create Collection Records on the Ledger Menu. The process in Export Payments also creates remittance records for the same amount. You should use one process or the other to avoid doubling the collection entries on your ledger. Most collectors prefer to use the records created during the Export Payments however we have left the Create Collection Records functionality for those that still use it. These are the only records that use the Discount and Penalty columns. Collections appear on line 4 of the Monthly Report.

Exemption

The program automatically creates Exemption records when you make a property tax exempt. The Bill Number, Control Number and Name appear in the Desc field. Exemptions appear on line 5 of the Monthly Report.

Exoneration

The program creates Exoneration records from a file provided by Tax Claim. They will appear on line 6 of the Monthly Report.

Remittance

You will create a Remittance record each time to remit money to a taxing body. If you have the program create ledger entries when you create the Export Report, you do not need to create the record yourself. If you need to create a record manually, enter Remittance as the type, the date of the remittance, the year and month on which you want the entry to appear and the amount in the Face column. If you have a Transaction # that you want to report, you should enter that in the Desc Column. Remittance records should contain the net amount (face less discount plus penalties) remitted to the taxing authority in the first amount column. The column is labeled face because that is how it is used for collection records but for a remittance record it must contain the net amount. Remittance records appear on line 14 of the Monthly Report.

Interest

You will create interest records if you have interest you need to report to the taxing bodies. Enter the date of the interest, Interest as the type, the month on which you want to entry to appear and the amount in the Face column. Interest records will appear on line 18 of the Monthly Report.

Lien Record Type

In order to produce an end of the year report you will need to create a lien record. The unpaid balances become liens when turned into Tax Claim and the final report should have a balance of 0 in line 8. The program can produce these records for you automatically when you create the Tax Claim Return. If you choose to create these records manually, create a lien record with the unpaid real estate balance in the Face column and the unpaid occupation balance in the Occ Face Column. Enter a report year and month for the final period for the Lien record.

Other Record Type

Some tax collectors must deposit the checks from a taxpayer directly into the school district’s bank account. In this case, they need to account for the overages/underages. If you need to do this, you may create ledger records with a type of Other. The amount you put into the face column may be either positive or negative and will appear in the Other column on line 12 and be totaled into the amount on line 13 of the Monthly Report.

If you have a problem with any of the records in the ledger, you can correct the amounts. The ledger records are used only to produce the Monthly Report so changing them does not affect any other part of the program. The Print button will create a printable copy of the ledger that is more convenient than printing the Ledger Form from the screen.

Create Collection Records

The program will prompt you for a start and end date just as it does for the distribution reports. The Collection records are created for all Payment Periods at the same time. The program creates a new set of collection records each time you click the button labeled Create Collection Records. If you have created extra collection records, you can delete them in the ledger by clicking on the record selector (the gray box to the left of the record type) and then pressing the delete key on your keyboard. You can create collection records each time you enter collections, weekly, monthly or on any other interval that you find convenient. The program will summarize all of the collection records for a report month on the Monthly Report no matter which method you choose. This process creates the collection records for the County, Municipal and School taxes as separate processes. This allows the Tax Collector different time periods to create the collection records for the three taxes. After the School Taxes are created this process will have to be run three times in order to create the collection records for all kinds of taxes. You also receive the option of having these collection records created at the end of the Export Payments process.

Monthly Report

To create the Monthly Report, click on the Monthly Report button on the Ledger Menu. The program will prompt you for information to create the report. First, the year and month for which you are running the report. All ledger records with that year and month will appear in the appropriate area on the report. All prior ledger records will be used to compute the Balance Collectable on line 1. Second, the Tax Type. The program will create a separate report for each taxing body. Third, the Twp/Boro. Most municipalities have only one choice, however some will need to run the report for each of their districts. You may optionally enter the amount you are remitting with this report if you have not created a remittance record for it yet. This amount will appear on line 15 and be totaled into line 16. Finally, you will find a check box labeled Year-End. If you check this box, the program will indicate in the title that it is the Year-End report.

If there are any additions or deletions for the Monthly Report, they appear on a Monthly Report Detail that the program automatically creates at the same time. This is intended to make it easier for the taxing body to identify which bills the tax collector has changed because it displays less information than the Treasurer and the New Bill reports. However, since the entries displayed correspond to the Monthly Report, if the taxing body decides to use this report to insure that its bills match the tax collector’s, it may find mismatches on the tax amounts if the tax collector distributes a payment that has not appeared on the Monthly Detail Report. The program still creates the Treasurer and New Bill reports automatically when the tax collector exports the receipts so each taxing body can decide what works best for itself.