This is an old revision of the document!

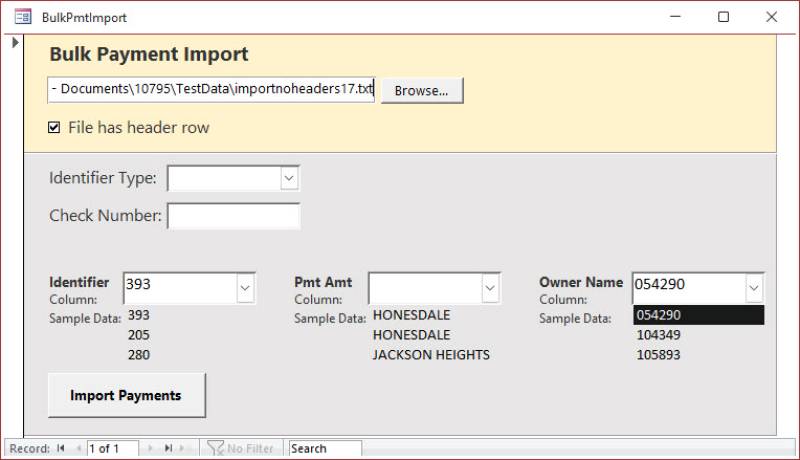

Bulk Import Form

Select New File

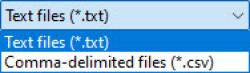

Click [Browse…] to choose the file you received from the mortgage company. If you have a .csv file, you can change the file type via the drop-down in file explorer.

File Has Header Row

Checking this box will remove the first row in the file during the import process. This is to handle electronic files that have a "header" row.

For example:

- CtlNumber,PaidBy,Bill,PaymentAmount

Would be examples of column names if a file had a "header row."

If in doubt, you can see how checking/unchecking the box will affect the options in the identifier combo boxes. If you don't see any header row, you can leave this box unchecked.

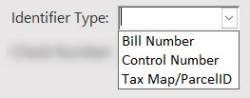

Identifier Type

Based on what you see in the data file, choose one of the three identifier "types" to match on:

- Bill Number

- Control Number

- Tax Map/Parcel ID

Check Number

Enter the check number for the payments you are importing (separate with commas if multiple checks for one file)

Selecting Identifying Information

The identifying information is necessary to import the payments. This helps link the electronic file information to the data in TaxColl2k.

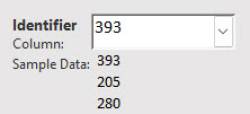

Identifier

- Bill Number

- Control Number

- Tax Map/Parcel ID

Make sure to identify the data correctly using the "Identifier Type" dropdown above the "Check Number" field.

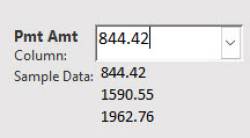

Pmt Amt

Owner Name

While not mandatory to select, try to identify using the sample data what is most likely the owner name column

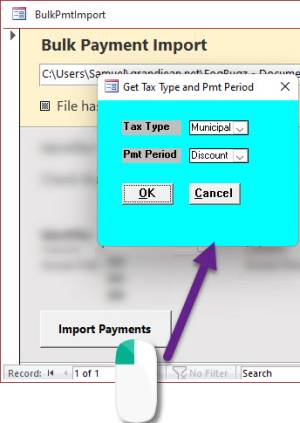

Import Payments

Clicking the [Import Payments] button will begin the import process. If the identifier and payment amount have been selected, you will be prompted to provide the Tax Type and Payment Period this electronic file was made for:

Once the payments have been imported, the "Pending Payments" report will open and display any payments categorized as one of the following:

- Overpayment (partial refund: will still be added as a receipt)

- Underpayment (full refund)

- Already paid (full refund)

- Parcel not found (full refund)