This is an old revision of the document!

Rebate Reports

Rebate Worksheet

Opening and Analyzing

Let's open the Rebate Worksheet.

From the "Edit Rebate" form, click the "Rebate Worksheet" button on the bottom underneath the "Tax Payment Details" subform.

The "Rebate Worksheet" will appear as a report.

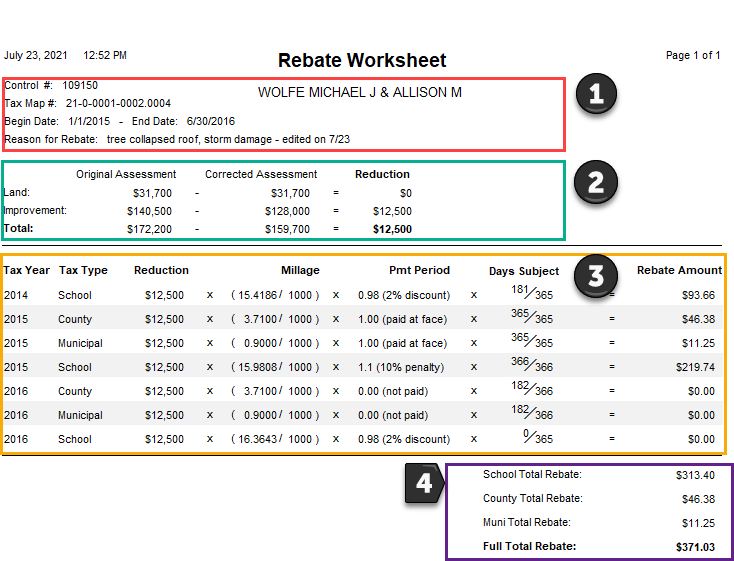

The Rebate Worksheet:

Where numbers are assigned in the picture, read the details for each section where the numbers relate.

- Owner information, rebate information

- Original, corrected, and reducted assessment values and their totals

- Each tax payment detail record and how the rebate amount for each tax bill was calculated. Can be verified by the user by completing the calculations displayed left to right.

- The running totals of the individual school, county, and municipal rebate amounts along with the sum of all three for a total rebate amount.

Payment Periods and Days Subject

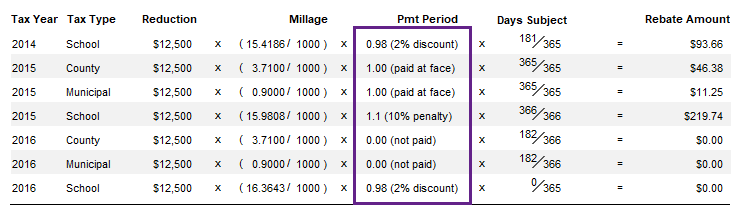

Payment Periods:

For the sake of demonstrating the rebate worksheet, the payment periods for our scenario have been varied

(previously, they were all entered as "Discount").

Let's look at how each payment period type affects the values on the "Rebate Worksheet."

The payment period exists as a number with a decimal whose value changes depending on which

payment period was selected. For instance, a payment period of "face" will always be 1.00,

as no penalty nor discount exist. A payment period of "not paid" will always be 0.00.

For the school tax year of 2015, the penalty percentage is 10%; therefore, the "Pmt Period"

value we multiply by is 1.1, which adds the penalty to the running number. The same is true

for the 2% discount, except its value exists as the percentage amount less the value of 1.00.

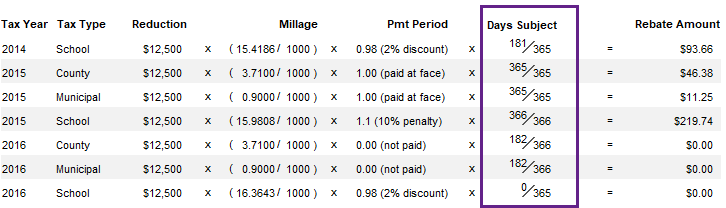

Days Subject:

The "Days Subject" column signifies the number of days in the tax year per tax type subject to the rebate's scope.

For the school bill in 2014, we can see that the running number is multiplied by the operation, 181 divided by 365.

This means, that since our rebate started January 1st, 2015, we are accounting for the days within the 2014 school

bill that the rebate takes effect on (which would be January 1st - June 30th of 2015).

The days in the 2014 school bill between July 1st, 2014 and December 31st, 2014 are not subject to the rebate, so

they are excluded from the operation.