This is an old revision of the document!

Editing a Rebate

Opening "Edit Rebate" Form

The three ways to open the "Edit Rebate" form.

By "Add Rebate"

The first way to open the "Edit Rebate" form is by clicking the grey "Add Rebate" button on the "Add Rebate" Form

after filling in the relevant fields with good data.

By "Rebate Search Results"

An alternative way to open the "Edit Rebate" form is by clicking the "Edit Rebate" button on the

"Rebate Search Results" form while the existing rebate is selected.

By Double-Click

Or, another alternative, convenient way to open the "Edit Rebate" form is by simply double-clicking

on the rebate you wish you edit on the "Rebate Search Results" form.

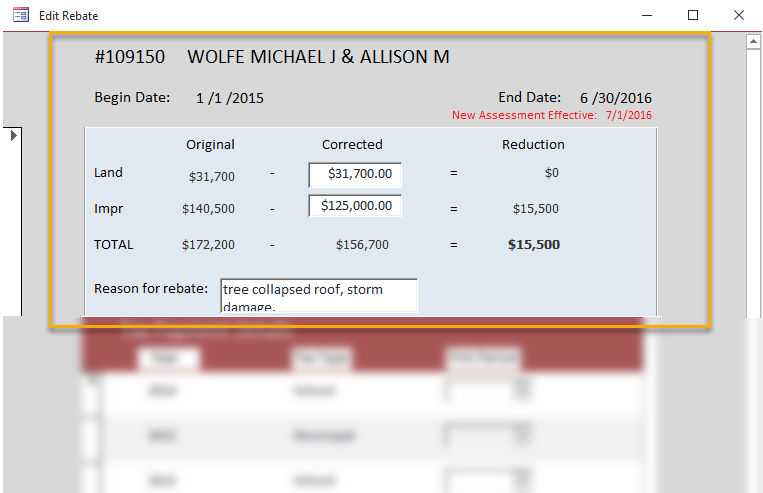

A Look at the "Edit Rebate" Form

The Top Section:

The top section of the form contains the following:

- The rebate's owner's control number and full name

- The rebate's start date (Begin Date) and end date

- The reason for the rebate's end date (the red text)

- The "blue matrix" from the "Add Rebate" form that holds the original, corrected, and reducted values along with the reason for the rebate.

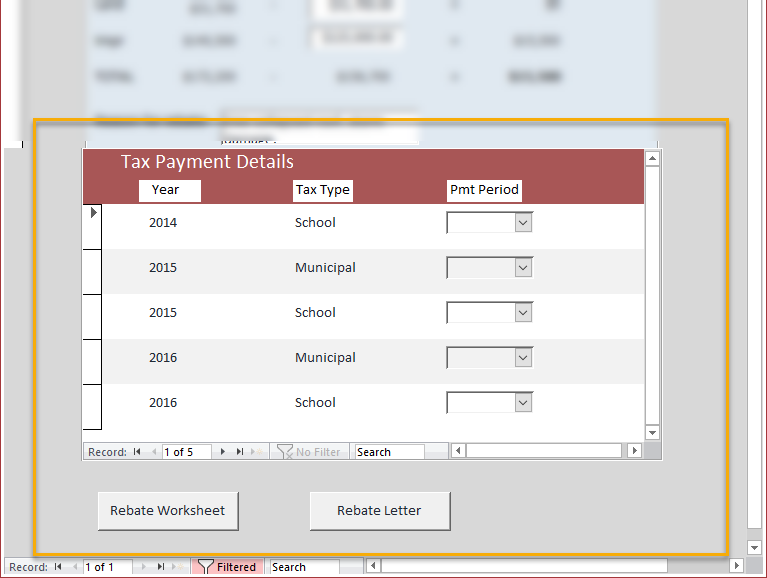

The Bottom Section:

The bottom section of the form contains the following:

- The subform, "Tax Payment Details," that creates records for each tax bill based on the span of the rebate.

- The "Rebate Worksheet" button that generates a report detailing how the rebate amount is calculated.

- The "Rebate Letter" button that generates three letters for each taxing district and details the rebate amount owed to the specified property owner.