Table of Contents

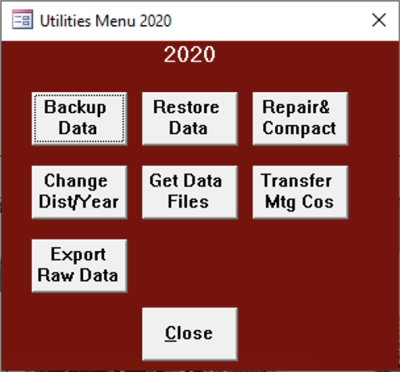

Utilities Menu

It is extremely important that you back up your data frequently. You can restore the program from the installation disks and the most recent update. The data however might be lost unless you backup the data files. In order to backup the data you must copy the files in the TaxCollection folder named X####DD.mdb where X is either M for municipal or S for school, #### is the year and DD is the 2 digits of the tax district. For example, District 1’s Municipal tax data for 2010 is contained in a file named M201001. The school tax data for 2010 for district 14 will come in a file named S201014.mdb. All files are located in the TaxCollection folder.

Backup Data

The program provides an optional way of backing up the tax collector data files. If you are satisfied with your current backup procedures, you do not have to use this process. When you click on the Backup Data button the program will prompt you to enter where you want the backup to go. If you backup to an external hard drive or flash drive, and provide a folder name, the program will create the folder for you before copying the data files for the current tax year. These drives come in large sizes relative to the size of the data files so it makes sense to keep multiple backups. The program assists with this by adding the date to the end of the name of the backed up files. The exact number of backups that will fit on a flash drive depends on the size of your district and the capacity of the flash drive. A 2GB flash drive can hold about 200 copies of the municipal and school files for the largest district. If you use more than one flash drive, and alternate their use, you protect yourself from the possibility of a flash drive failure or its loss. These processes only backs up your tax collector data files for the year you have open; you should take other steps to protect other data on your computer. If you save your original data disks, you can install them again in case you ever need to see what was on them before you made any changes or posted payments. BEFORE you reinstall the originals, you should make a backup so you do not lose any of your work. The program does not back up to CDs.

Restore Data

The program will prompt you for the location of the backup you made using the Tax Collection program and the year of the file you wish to restore. After you click ok the program will present you with a list of backups that it found with the most recent at the top of the list. If you click the check box in the Select column, then click OK the program will restore the backup made on that date. If the backup includes both the municipal and school files, then both files will be restored.

Repair & Compact

This is a process that can sometimes recover corrupted data files. I hope that you will never need it but if it does not work, you will still have a recent backup, right?

Change Dist/Year

This allows you to switch between tax years. If you switch to a year prior to the current calendar year, the forms will have a yellow background to alert you that you are not in the current file. If you need to access files from a previous tax collector with same year as your files, see the Adams County Addendum at the end of this document.

Get Data Files

This will prompt you for Municipal or School. When you click OK it will download the data file you requested. If you requested Municipal data the program will attempt to download the file for the next year. That means if you have the 2016 tax year open it will look for the 2017 file. If you requested School data the program will attempt to download the file for the year you have open. If the data file already exists on your computer, the program will not download it again. This is so that you cannot accidentally delete your current file. You must have an internet connection for this to work.

Transfer Mtg Cos

This will copy the will copy the mortgage company assigned to a property from the previous billing. For the 2016 school bills the assignment will copy from the 2016 municipal bills. For the 2017 municipal bills the assignment will copy from the 2016 school bills. For those tax collectors that only collect one kind of tax the assignment will transfer from the previous year. Export Raw Data will allow you to save your bill and receipt information to a text-based .csv file. If you have Microsoft Excel, it will open the file for you. If not, you can open the file in Notepad. This allows you to search through all of your data to find a bill or receipt with a specific amount due or paid. It’s not meant for everyday use, but it can be a real lifesaver for tracking down problems. Please be aware that bill information is repeated for each receipt. So if a bill was paid in installments or has been voided it may show up multiple times in the export.