Table of Contents

Transfer Files From Another Computer

If you acquire a new computer or are transferring data to a new tax collector, you should follow these steps to ensure a smooth transition.

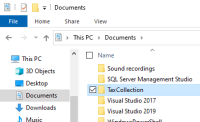

Your data is stored in a folder named "TaxCollection" in the Documents folder.

- Copy the "TaxCollection" folder from your old computer to a flash drive or external drive.

- Copy the "TaxCollection" folder from your flash drive or external drive to your new computer's "Documents" folder.

That's it! If you're not sure how to do the above steps, read below for a step-by-step breakdown of the process with screenshots.

Step-by-Step with Screenshots

Copy from Old Computer to Flash Drive

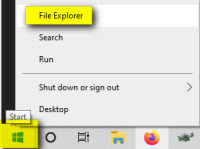

- On the left sidebar, scroll down and double-click "This PC", then double-click the "Documents" folder

- Right-click the TaxCollection folder and choose "Copy"

- Double-click "This PC" in the left sidebar

- Your flash drive or external drive should appear (plug it in if it's not already plugged in)

- Double-click on your flash drive in the "Devices and drives" section to open your flash drive

Copy from Flash Drive to New Computer

- On the left sidebar, scroll down and double-click "This PC"

- Your flash drive or external drive should appear (plug it in if it's not already plugged in)

- Double-click on your flash drive in the "Devices and drives" section to open your flash drive

- Right-click the TaxCollection folder and choose "Copy"

- Double-click "This PC" in the left sidebar, then double-click the "Documents" folder